Ratio analysis is the quantitative interpretation of the company’s financial performance. It provides valuable information about the organization’s profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements.

This is the most comprehensive guide to Ratio Analysis / Financial Statement Analysis.

This expert-written guide goes beyond the usual gibberish and explores practical Financial Statement Analysis as used by Investment Bankers and Equity Research Analysts.

Here I have taken Colgate Case Study (2016 to 2020 financials) and calculated Ratios in excel from scratch.

Please note that this Ratio Analysis of the financial statement guide is over 9000 words and took me 4 weeks to complete. To save this page for future reference and don’t forget to share it :-)

Step 1 – Download the Colgate Excel Model Ratio Analysis Template. You will be using this template for the analysis

You can download this Colgate Ratio Analysis Template (Solved and Unsolved) here –Step 2 – Please note you will get two templates – 1) Unsolved Colgate Model 2) Solved Colgate Model

Step 3- You should start with the Unsolved Colgate Model Template. Follow the step-by-step Ratio Analysis calculation instructions for analysis.

Step 4 – Happy Learning! :-)

Table of Contents

Framework for Ratio Analysis

Ratio analysis of financial statements is another tool that helps identify changes in a company’s financial situation. A single ratio is not sufficient to adequately judge the financial situation of the company. Several ratios must be analyzed together and compared with prior-year ratios, or even with other companies in the same industry. This comparative aspect of the analysis is extremely important in financial analysis. It is important to note that ratios are parameters and not precise or absolute measurements. Thus, ratios must be interpreted cautiously to avoid erroneous conclusions. An analyst should attempt to get behind the numbers, place them in their proper perspective, and, if necessary, ask the right questions for further types of ratio analysis.

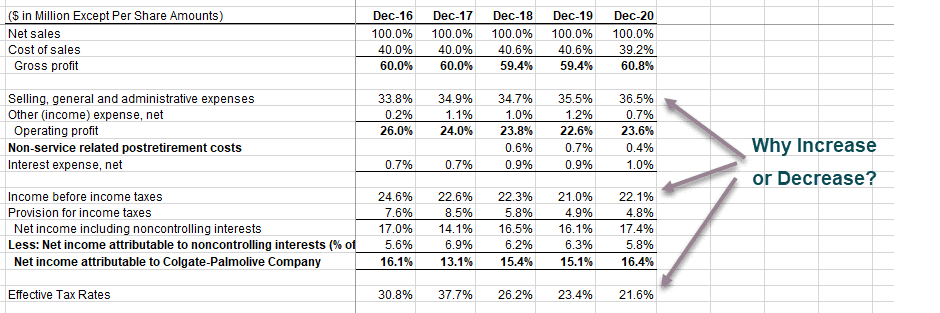

#1 – Vertical Analysis

Vertical analysis is a technique used to identify where a company has applied its resources and in what proportions those resources are distributed among the various balance sheets and income statement accounts. The analysis determines the relative weight of each account and its share in asset resources or revenue generation

What can we interpret with Vertical Analysis of Colgate?

Ratio Analysis – Explained in Video